STRENGTHENING ELECTRIC VEHICLE SUPPLY CHAINS THROUGH PRO-ACTIVENESS AND RESILIENCE

With OEMs racing to fullfil ambitious electric vehicle (EV) adoption targets, the required readjustment of automotive supply chains coupled with increased geo-political tensions and macro-economic instability have exposed vulnerabilities in traditional supply chain models.

Since the pandemic started, automotive OEMs have continuously struggled with a shortage of semiconductors and other vital parts. These shortages have shrunk production, slowed deliveries, and sent vehicle prices soaring.

Now, the war in Ukraine has dramatically accelerated these challenges. Critical electrical wiring manufactured in Ukraine has suddenly become out of reach. Russian exports of nickel and lithium for EV battery production have decreased significantly. Additionally, OEMs have announced that they are canceling production in Russia, which makes up about 10% of the Europe’s total production capacity [1].

Further increasing the price pressures for OEMs is inflation, which in the EU area increased to 8.1% in May of 2022 [2]. Energy prices have soared and now stand 45% above their level one year ago [3]. As a result of these challenges, forecasts now suggest that vehicle sales in Europe will decrease by 7.4% in 2022 [4].

AUTOMOTIVE Supply Chain disruptions:

Increased frequency and severity

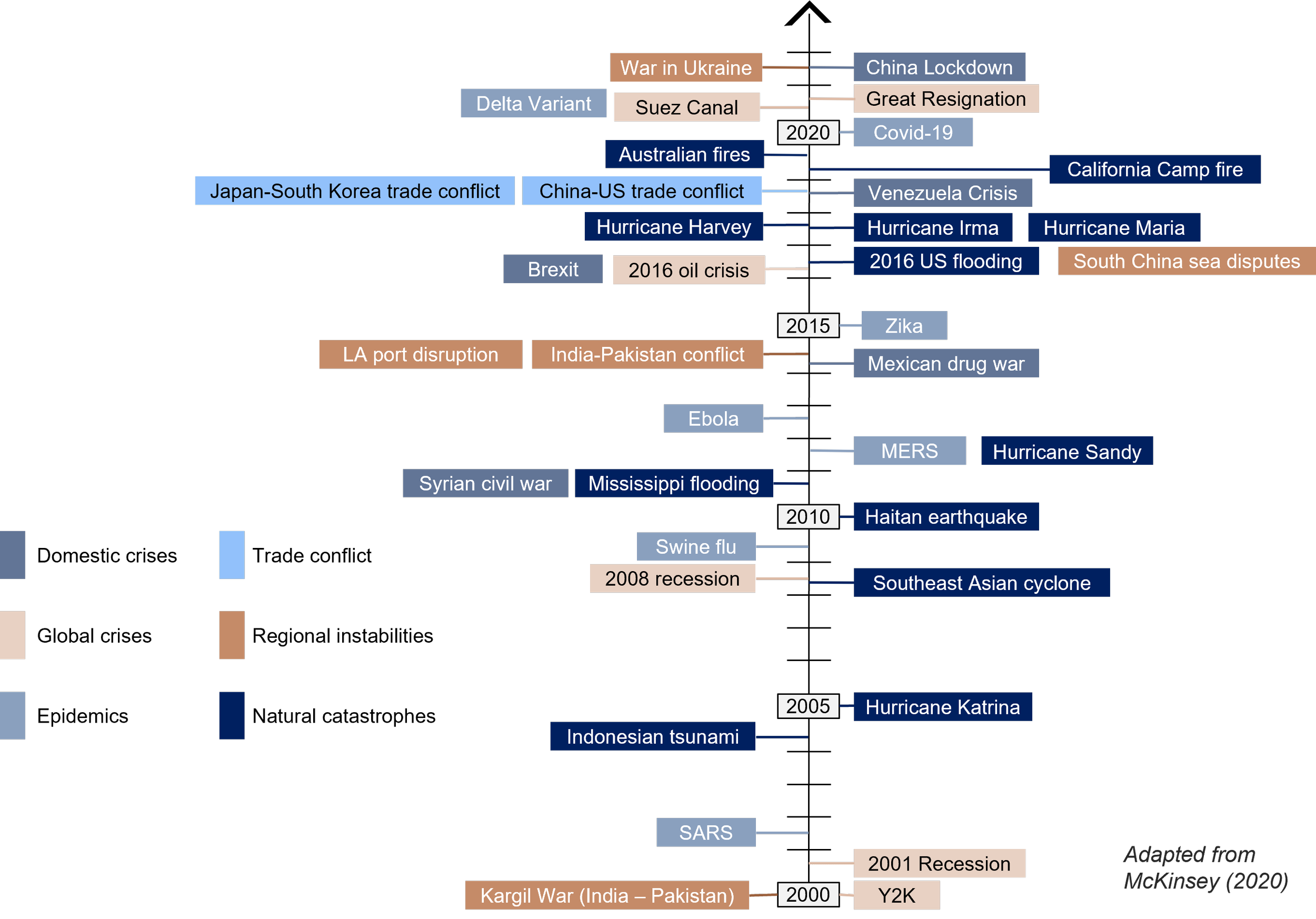

Military conflicts, pandemics, and inflation surges are inherently shocking – but they should not be surprising. Recent history suggests that the frequency and severity of geopolitical events causing supply chain disruptions is increasing (illustration below).

In the foreseeable future, we will likely see additional challenges from increasing rates of disruptive weather events due to climate change.

This should be a wake-up call for OEMs with ambitious targets regarding EV adoption since the main challenge in fulfilling these targets involves overcoming supply chain constraints. As the number of EVs on our roads increases, the supply of batteries will become an increasingly important (and competitive) area. As of now, supply is not keeping up with the strong growth in demand.

The silver lining is that EV value chains are not yet fully established for many OEMs. This provides manoeuvrability, allowing OEMs to take recent evidence of supply chain fragility into consideration.

MITIGATING THE CHALLENGES:

What should OEMS do?

To ensure that EV adoption targets are met, OEMs should move from reactive to proactive mitigation of supply chain challenges, while increasingly incorporating resilience in their operating models. In practice, this involves focusing on three areas:

VERTICAL INTEGRATION OF CRITICAL SUPPLY CHAIN activities

In recent decades, OEMs have outsourced large parts of the manufacturing process, focusing instead primarily on design, supplier management, marketing, and parts assembly. We are now seeing a shift, where OEMs employ greater control of their value chains.

This shift towards control has been pioneered by Tesla, which has long focused on internalizing most aspects of production. Elon Musk has claimed that his company is “absurdly vertically integrated”, and this strategy has paid off. Tesla have even stated recently that they might start mining and refining lithium directly at scale. With Tesla’s market capitalization now being roughly equal to the combined value of the other nine biggest carmakers, OEMs are realizing that control represents a competitive edge in an environment of fragile and complex supply chains. As Jim Farley, Ford’s CEO recently stated: “The most important thing now is that we vertically integrate”.

This might represent the end of a long period of outsourcing to big suppliers like Bosch and Continental, who sold similar components to many OEMs using scale to reduce prices. This freed up capital for carmakers but made supply chains fragile and hindered innovation. Stellantis has said that their cars are 85% “bolt-on parts”. Mercedes-Benz puts the value-added split at 70-30 in favor of suppliers. Many established OEMs now want their ratios to resemble Tesla’s more closely, which is around 50-50.

STRAtegic partnerships with suppliers of key inputs

For EV adoption, focusing on control should start with raw materials. As demand for battery minerals continues to outstrip supply, car firms should strike deals to make sure that shortages don’t stop production. BMW, Stellantis, Renault, GM, BYD, Ford, and Tesla have all signed large deals to ensure the supply of lithium. Such investments are growing increasingly commonplace and will spread to other potential bottlenecks, such as rubber, sheet metal, and aluminum.

OEMs should also aim to reduce their dependence on certain markets (such as China and South Korea) for battery manufacturing, bringing production closer to home to keep supply reliable and costs in check.

In this area, most companies prefer to team up with specialist producers, such as Northvolt, LG and SK Innovations, often through joint ventures. Such partnerships allow OEMs to share the large upfront investment costs, and it allows easier access to specialized R&D capabilities that would take a long time to build up in-house.

The lost production last year because of the global chip shortage has also made the industry forge closer links with chip designers such as Qualcomm and Nvidia, which would once have sold chips to firms far down the carmakers’ supply chain.

Supply chain resilience through stress testing

Depending on where automotive OEMs experience most supply uncertainties, OEMs are also making focused investments in supply chain resilience, keeping in mind the dependencies of critical components and suppliers. These investments can involve compromising on scale efficiency in favor of selective dual-sourcing or accepting a higher price in exchange for supply guarantees over longer periods of time.

Stress-testing the global supply chain enables identification of liabilities at all supplier levels. To do this effectively, OEMs should consider risk factors such as the density of spending related to specific suppliers or geographic locations. By looking into the depth of supply chains and interconnectivity of suppliers, decision makers will also get a better understanding of the extensive network of sub-tier suppliers which can cause fragility. As an example, OEMs might identify certain ‘high-risk’ suppliers that provide a vital delivery yet are small or dependent on a single company. By making these realizations, OEMs are better equipped to understand where efforts need to be made to mitigate value-chain risks.

Depending on the conclusion from these stress tests, OEMs might need to reevaluate their devotion to just-in-time (JIT) production and corresponding low stock levels. For the JIT model to work, the quality and supply of raw materials, the production of goods, and the customer demand for them must remain in alignment. If the JIT dimensions are misaligned, materials and components which are crucial to production but unsteady in supply should be stockpiled to ensure growth. For example, companies like Nissan and Toyota have significantly increased their chip inventory levels. However, one must keep in mind that rising interest rates will increase the value of working capital (e.g., cash and cash equivalents), making capital bound up in inventory more expensive – thus making stockpiling more unattractive as a strategy.

Each OEM therefore needs to individually weigh the pros and cons of different levels of inventory and reach their own conclusion. While stockpiling always appears to be an expensive strategy on paper, the assessment will likely change when factoring in the complexity of sourcing resilience and the cost of lost production.

Conclusion:

Looking Forward

In summation, required readjustment of supply chains to meet increased EV demand, coupled with macroeconomic and geopolitical instability, has made the need for resilient supply chains more prominent than ever before.

Every OEM needs to make their own assessment of where their value chains can be strengthened, and which methods are most suitable to accomplish the desired level of resilience. Determining critical areas of potential improvement should be done by assessing the interconnectivity, dependency and/or geographical concentration among critical suppliers which cannot be easily substituted.

When improvement areas have been identified, OEMs need to determine how to best strengthen these. Based on recent evidence, many OEMs are deciding that this involves vertically integrating selected areas of sourcing or production and forming strategic partnerships with key suppliers to develop long-term knowledge that over time can be leveraged in-house.

Staffan Brahe

Partner

+46(0)76-517 27 83

staffan.brahe@fortos.se

Andreas Janson

Consultant

+46(0)73-619 58 74

andreas.janson@fortos.se

Maria Ivarson

Partner

+46(0)76-517 29 22

maria.ivarson@fortos.se

References:

[1] ACEA (2021) The automobile industry pocket guide 2021/2022

[2] Eurostat (2022) Euroindicators

[3] European Central Bank (2022) ECB Economic Bulletin, Issue 4/2022

[4] LCM Automotive (2022) Western European Passenger Car Sales Update